salt tax deduction repeal

The state and local tax deduction cap set to expire at the end of 2025 limits the amount of state and local taxes that taxpayers can deduct from their federal taxes to 10000. Not in these quarters.

New Bill Seeks To Restore Federal Salt Deductions Capped Under 2017 Tax Act

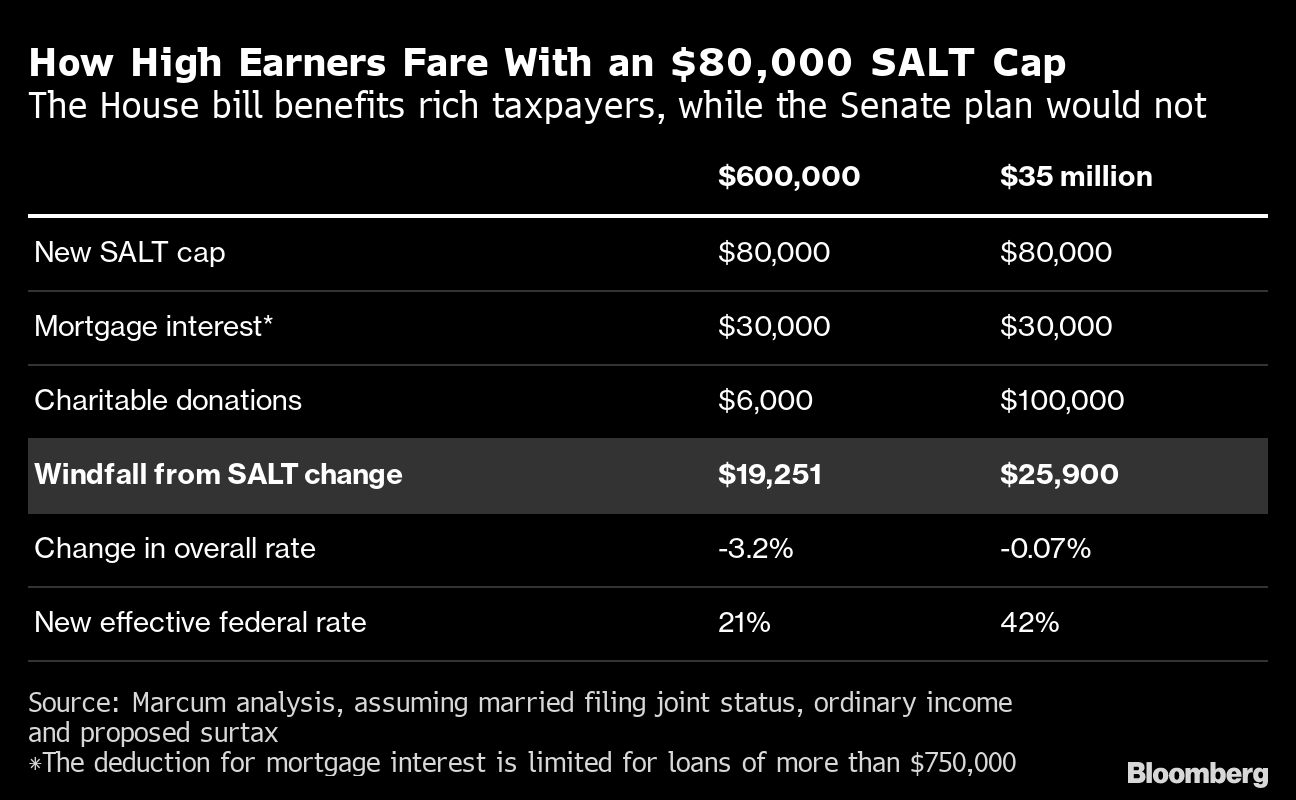

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000.

. The 10000 limit on the amount of state and local taxes deductible from federal income was enacted in. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Two single filers may each take up to 10000 in SALT deductions but jointly filing means only one 10000 deduction can be taken.

The House-passed Build Back Better Act for example would raise the cap. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. The 2017 Tax Hike Bill may have lowered taxes in other parts of the country but in Northern New Jersey the average tax bill went up.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. The Tax Cuts and Jobs Act. Doubling the cap to 20000 would remove.

The deduction cap should be fully. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say theyll vote for the. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

Tom Suozzi writes For 100 years Americans relied on this deduction Letters. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. Lawmakers in high tax states particularly Democrats are pushing for a repeal of the 10000 cap on the SALT deduction.

Unchanged is the SALT state and local income tax deduction cap. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. But such a repeal would mostly benefit high-income.

At least hes trying. The rich especially the very rich. As alternatives to a full repeal of the cap lawmakers and.

House Votes to Temporarily. The 10000 cap on our State and Local Tax deduction has. Lawmakers are currently considering possible changes to the state and local tax SALT deduction.

The lawmakers have asked. 54 rows The value of the SALT deduction as a percentage of adjusted gross. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. One way to offset that cost would be to eliminate the state and local tax SALT deduction which is capped at 10000 through 2025 and tends to benefit higher-earning. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

Shake On It Repeal The Terrible Salt Tax Deduction Cap New York Daily News

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

What Salt Tax Cap Repeal Could Mean For Florida S Migration Momentum Tampa Bay Business Journal

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Letter Argument Against Salt Tax Repeal Misleading

Democrats Salt Tax Deduction Repeal Would Benefit The Rich Opinion

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

The Push To Repeal The Salt Cap The Long Island Advance

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

Ocasio Cortez Votes Against Repeal Of Salt Deduction Cap

Sen Charles Chuck Grassley On Repealing The Salt Tax River Cities Reader

Congress And The Salt Deduction The Cpa Journal

Salt Cap Repeal Salt Deduction And Who Benefits From It

Local Officials Push To Repeal Salt Deduction Cap

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

House Likely To Act Soon To Restore Salt Deduction Crain S Chicago Business